The discussion around improving access to higher education —specifically due to the decades-long price increase of a four-year degree — is typically framed as whether or not college should be free.

The question is more complex than political debates allow for, but let’s start with

some facts:

- College is unaffordable to the vast majority of American families

- 20% of high school students are considering delaying college—or skipping it altogether

- 30% have considered taking a gap year between high school and college

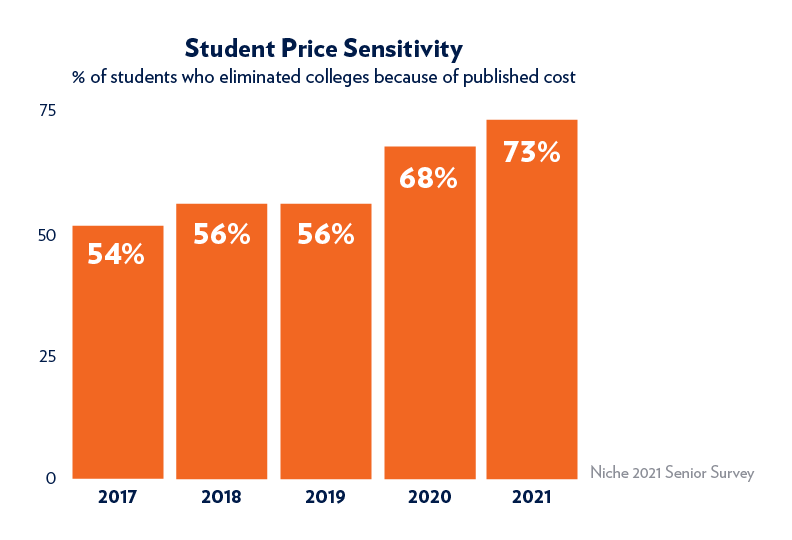

- 73% of high schoolers are eliminating certain colleges from consideration because of the sticker price

Nonetheless, free-vs-not-free is a false dichotomy. And it oversimplifies the issues

surrounding who pays for American higher education (and how much).

Here in the United States, rising income inequality has led us to a place where the wealthiest 1% hold more wealth — 15x more — than the bottom 50% combined. Yet, income inequality is a downstream problem. It’s the result of education inequality in which all but the wealthiest families are priced out from obtaining high-quality instruction at an affordable price.

Nonetheless, free-vs-not-free is a false dichotomy. And it oversimplifies the issues surrounding who pays for American higher education (and how much).

For most Americans, access to higher education is gained through debt

The problem, however, with debt-driven financing is that it forces students to take on a daunting financial obligation at a time when many can barely afford gas and insurance for their cars. Moreover, loan repayments begin when a graduate’s earning potential is at its lowest, making it difficult for newly-minted graduates to buy homes or start families — two things that used to be more common among young adults.

But the implications of financing a college education through debt involve more than just the dollars and cents.

- First, students are increasingly comparing debt-to-potential-earnings when choosing a college major. But while the country undoubtedly needs more engineers,

it also needs artists, writers, philosophers, social workers, and musicians.

- Second, in many instances, it is parents who are incurring college debt on behalf of their children. The result is that students

have less skin in the game when it comes to accelerating academically, and are less likely to forge their own

personal (and lifelong) relationship with the institution.

It’s time to stop thinking about debt as the solution

The proliferation of student loan programs has done little to improve access to affordable higher education.

That’s because college access remains tightly linked to family wealth. For example, family wealth has a direct relationship with SAT scores which, in turn, leads to the wealthiest students receiving the most merit scholarship money.

Yet, at the same time, the sticker price of tuition isn’t fair to wealthy families either.

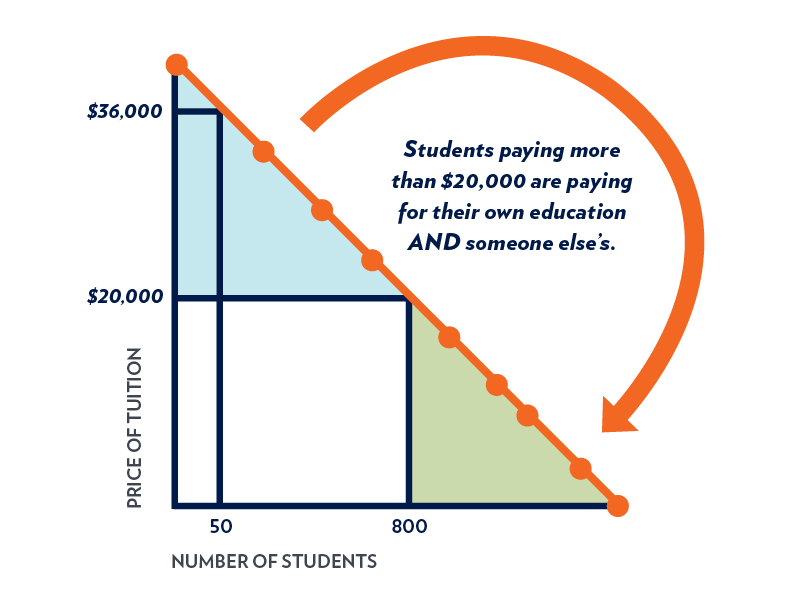

That’s because at many places the sticker price of a college education is at least double the average tuition rate. In effect, wealthy families pay twice-over - paying for their own education AND subsidizing scholarships for other students. While we can debate the ethics of such a model, one thing is clear: it isn't sustainable.

Can a mission-based financing model succeed where debt-based models failed?

For the 2021-22 academic year, Hope College is piloting a new model of financing a

college education called Hope Forward. Hope Forward is a mission-based model where students are selected not on merit,

need or ability to pay, but rather their appetite for impact. We are looking for students

who want to bring hope to hopelessness.

Under Hope Forward, we do not ask students to pay upfront for their education before they’ve realized any economic benefit. Hope Forward is neither a loan, nor an Income Sharing Agreement (ISA), nor a free education. Rather, it replaces the “pay-it-back'' model of college financing (i.e., where money flows to lenders) with one that is based on paying the benefit forward to future students.

As part of Hope Forward, the student makes a lifelong commitment of donating to the

college so that subsequent students can receive the same high-quality education at

no upfront cost. Hope Forward fundamentally challenges norms around who pays for higher

education — and when they pay it.

As part of Hope Forward, the student makes a lifelong commitment of donating to the

college so that subsequent students can receive the same high-quality education at

no upfront cost. Hope Forward fundamentally challenges norms around who pays for higher

education — and when they pay it.

Reactions to Hope Forward have ranged from outright praise to guarded skepticism.

It is without doubt, however, that we’ve devised a new model that’s putting an end

to student debt, and to all of the problems that student debt causes.

I invite you to comment and share your experiences with student debt. What sacrifices

did you (or your parents, or your children) make to attend college in America? How

might your life be different if you never had incurred student debt?

The overarching theme of all articles in this series is the importance of eliminating student debt as a means

of accessing quality education. In my next article, I’ll look at the value and importance

of the four-year degree program in the context of “pathway programs” that help young

adults land their first jobs in a shorter (and less expensive) timeframe.

Learn more about Hope Forward, an entirely new funding model for tuition at Hope College